Digital Assets, like Blockchain, are buzzwords actively used in this money era and a lot of times used wrongly, as it stands you might have invested or owned some form of digital assets without having a full understanding of what it is. Statistics show that investments in “Digital Assets” have gained so much popularity over the years and have got a lot of people interested in investing because it is believed that it can generate high returns in a short time.

As juicy as this may sound, you need to have a good understanding before dabbling into it. Stick around and you will surely learn what it is all about.

What are Digital Assets?

To begin, let’s look at what digital assets are in the general sense of it — they are electronic files of data that can be owned, stored, and transferred. They include but are not limited to photography, logos, digital documents, audible content, illustrations, audiovisual media, digital paintings, cryptocurrencies.

Note: It can only be called an asset if it is backed by a right of usage. Without such rights, data cannot be considered an asset.

In the context of blockchain, digital assets include cryptocurrencies and crypto tokens. Cryptocurrency and tokens are unique subclasses of digital assets that utilize cryptography- An advanced encryption technique that assures the authenticity of crypto assets by eradicating the possibility of counterfeiting.

The key differentiation between the two classes of a digital asset is that cryptocurrencies are the native asset of a blockchain — like BTC or ETH — whereas tokens are created as part of a platform that is built on an existing blockchain, like the many ERC-20 tokens like Chainlink (LINK), Tether (USDT), Shiba Inu (SHIB) … which all make up the Ethereum ecosystem.

An increasing number of companies worldwide are using bitcoin and other digital assets for a host of investment, operational, and transactional purposes.

The use of crypto for conducting business presents a host of opportunities and also challenges. One of the major challenges includes the complexity surrounding the technical components, the cost of operation, and security.

That’s where companies like bitpowr come in, to make it easy.

Types of Crypto Digital Asset?

There are numerous ways the digital asset blockchain can help to revolutionize the global economy, increasing efficiency and clearing the door for previously unimaginable opportunities. Below are a few types of digital assets that exist.

1. Cryptocurrencies

Are digital currencies that use cryptographic foundation i.e approaches and techniques to store value, facilitate exchange, and operate as a unit of account. In addition to Bitcoin, there are currently several other cryptocurrencies like Ethereum, and Litecoin available for purchase and investment.

2. Crypto commodity

_image: currency.com _

Crypto commodity is a general term used to describe a tradable or fungible asset that may represent a commodity, utility, or contract in the real or virtual world through exclusive tokens on a blockchain network. It works like this — let’s say gold is the commodity (crypto commodities), which can be used to create gold necklaces, bracelets, and rings. All of the gold products now have new values because Gold has given them such value, in the same way, that crypto commodities like Ethereum can create new digital assets with new values, such as Shiba.

3. Utility tokens

image: hl-lawyer

Utility tokens are like digital coupons. A utility token can serve just about any purpose a developer wants it to. In general, utility tokens provide access to a specific service or product with a blockchain ecosystem. Non-fungible tokens (NFTs) serve as a type of unique utility token, too. An NFT token is a one-of-a-kind digital piece of art, although NFTs can also be applied to things like music. Examples of utility tokens are Binance Coin (BNB), Chainlink (LINK)

4. Security tokens

Security tokens get their value from tradable assets and other external sources that already have value, like a car, house, stocks, painting, or company shares. Because of their nature, security tokens are covered by federal securities regulations. A company wishing to distribute shares to investors can use a security token that offers the same benefits one would expect from traditional securities.

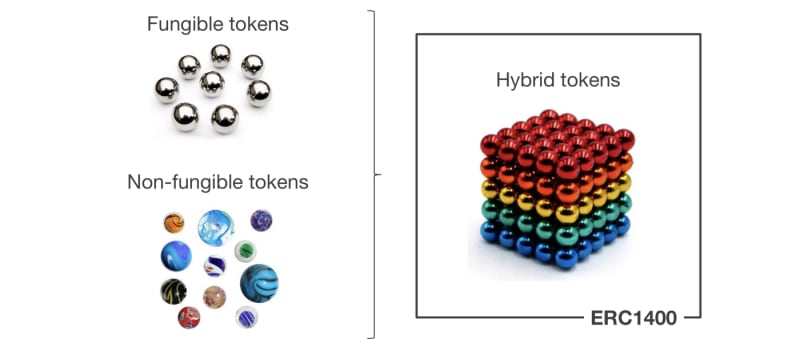

5. Hybrid tokens

opensource

These do not hold the conventional values of security tokens. However, hybrid tokens can be valued for both investment purposes and practical uses on a platform. They are beneficial for two different types of token holders: investors who hold for speculative value, and participants who want to gain the right to a specific product or service.

What can crypto Digital Assets do for your Business?

Zaha: photography

Your Business may be able to reach new customers if it uses digital assets like cryptocurrencies. Transparency is important to many crypto users; therefore, they’ll be more likely to buy from you if you use crypto. A recent poll suggests that up to 40% of crypto clients are new, and their purchasing power is twice that of credit card users, so with Bitpowr your business will be well-positioned to receive and disburse crypto assets smoothly using its wallet infrastructure.

Introducing digital assets like crypto today could help your company become more aware of this emerging technology and get a good position for a future where central bank digital currencies are a reality. This placement may potentially benefit the company’s position in this emerging market. Crypto could enable access to new capital and liquidity pools through traditional investments that have been tokenized, as well as to new asset classes.

Digital assets furnish certain options that are simply not available with fiat currency. For example, programmable money can enable real-time and accurate revenue-sharing while enhancing transparency to facilitate back-office reconciliation.

Crypto Assets may serve as an effective alternative or balancing asset to cash, which may depreciate over time due to inflation. Crypto is an investable asset, and some, such as bitcoin, have performed exceedingly well over the past five years. There are, of course, clear volatility risks that need to be thoughtfully considered, and bitpowr provides a multi-asset wallet solution that enables proper management of most of this investable asset which opens up a world of possibilities.

Conclusion

Ifyou are building on the Blockchain and need to manage your company’s crypto assets, you can use Bitpowr to maintain custody of your crypto assets on a blockchain and provide wallet management services that facilitate the tracking and valuation of the crypto assets.